Windsor-Essex Real Estate: What’s Real Right Now (And What You Can Do About It)

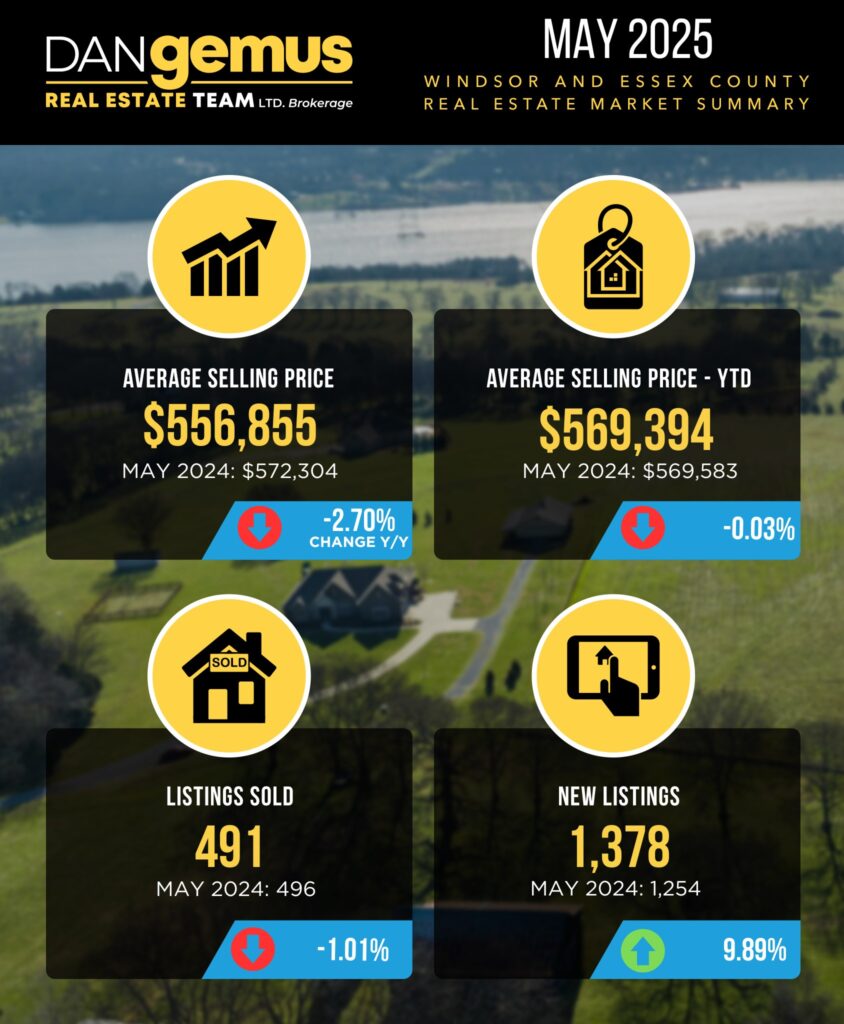

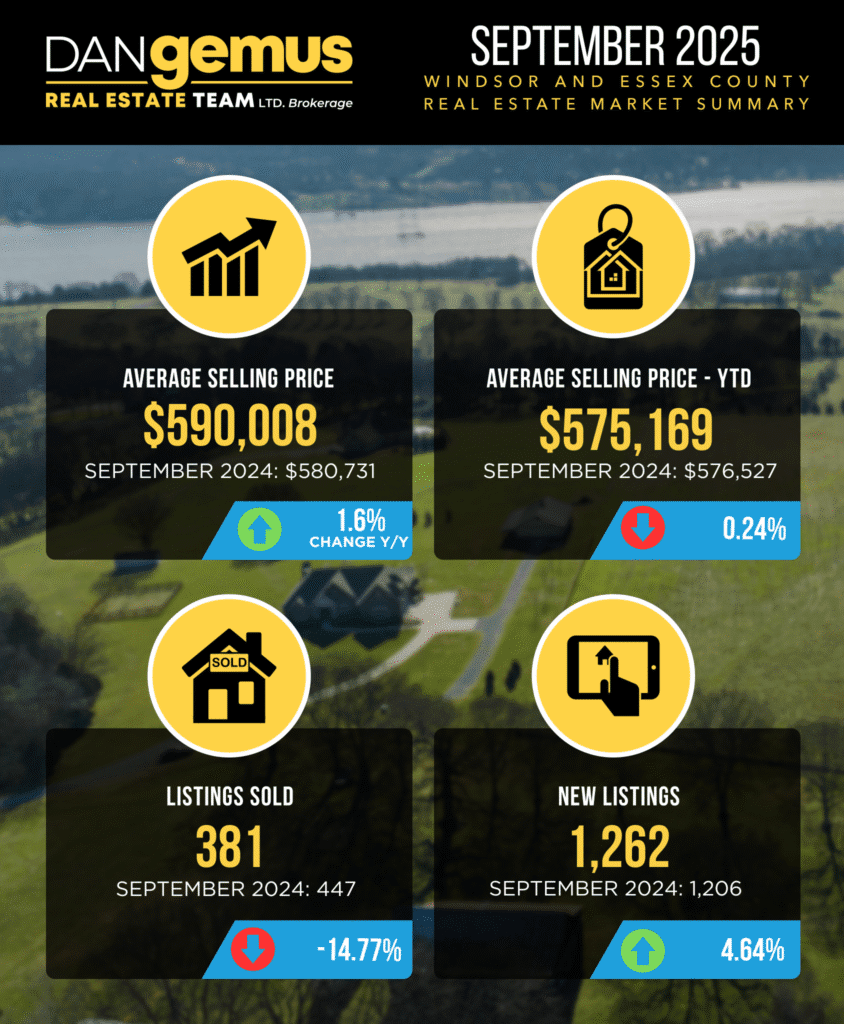

Over the past twelve consecutive months, residential inventory in Windsor-Essex has steadily climbed. Buyers today have more options than they’ve seen in years. September’s average sale price was up just a tad year over year, landing at $590,008, but down marginally YTD at $575,169. The increase in inventory, has definitely putting downward pressure on pricing and we expect to see more pressure until the market absorbs this inventory. The most active price range remains between $450,000 and $650,000 as buyers search for affordable options, with bungalows leading the way as the most popular home style, followed closely by ranch homes.

The number of residential sales fell nearly 15% month over month. We have been seeing approximately 8=15 sales per day across the entire Windsor-Essex region, including all categories. So, the question for sellers becomes, how do you make your property stand out so it’s included in the list of sales?

In today’s market, whether you’re buying or selling, success depends on timing, strategy, and realistic expectations.

The Pitfalls of Overpricing in a Buyer’s Market

For sellers, the biggest mistake we are seeing right now is overpricing. With inventory continuing to rise month after month, buyers have plenty of choice and days on the market are stretched. An overpriced listing often lingers, becoming stale, and the longer it sits, the less leverage the seller has. Eventually, many of these homes sell for less than they would have if they had been priced properly from the start. The stats make it appear that the average days on market are hovering around three weeks, but the real experience, in many cases is that it’s much longer. Cancel-and-relist strategies stretch those timelines much longer, and buyers, armed with more choice, are quick to pass on anything that feels overpriced. It’s no wonder sellers, especially those that need to sell, feel stuck and buyers feel uncertain.

In a market where inventory is growing WAY faster than sales are happening, overpricing is the biggest pitfall. An overpriced home doesn’t just sit—it actively works against the seller by making fairly priced listings look like bargains.

We’ve seen this play out across Windsor-Essex: sellers who price “ahead of the market” (slightly under where the competition is sitting) are the ones who stand out. These homes often attract multiple offers and often sell within 30 days, even as others in the same neighbourhood sit stagnant.

Think of it this way: when buyers walk through ten homes in the same neighbourhood and yours is priced above all the others without clear added value, it doesn’t just get passed over—it helps sell the competition. There is a distinct difference between being “on the market” and “in the market” where homes are actively being bought and sold.

The silver lining? Many homeowners who bought before the pandemic, still have a strong equity cushion, which makes proper pricing even more important. By entering the market strategically, you can lock in gains while still standing out in a competitive environment.

Buyers: Why Preparation is Power

Even in a slower market, buyers can’t assume they hold all the cards. Many homes in the average price range of $450,000 to $650,000 are still attracting multiple offers, especially if they are well-presented and priced right. We just aren’t seeing the same kind of frenzy that we were during the pandemic – yes, this is, and will continue to be a reference point for some time.

Serious buyers need to be pre-approved for financing and ready to act. If buyer’s have to include a condition of selling their current home, they need to make sure it’s on the market and priced accurately to sell. Those who prepare now will be positioned to move quickly when the right home appears.

Patience and strategy remain key, but in the segments where demand is strongest, waiting too long, or lack of preparation can still mean missing out.

The Bigger Picture: Renting as a Long-Term Reality

Beyond the traditional buy-and-sell cycle, there is another shift taking place. Rising prices, borrowing costs, job instability, and stagnant incomes are forcing many families to embrace renting not just as a temporary step, but as a long-term solution. If this trend continues, we may see an entire generation of Canadians who view renting as their primary housing option.

This change opens new opportunities for investors and builders. Developing or owning well-located, high-quality rental properties may be one of the most resilient strategies for the future market.

Final Thoughts

The Windsor-Essex market continues to adjust. Approximately 1 in 3 homes are selling and the rest are still sitting, being cancelled or expiring. Sellers who align with market conditions can still achieve decent results. Buyers who are prepared can secure strong opportunities, sometimes even in competitive, multiple-offer situations. And investors who read the long-term shift toward renting may find some of the most stable returns of the decade.

The key is to recognize that there isn’t one “right” move for everyone. Sometimes selling or buying now makes sense. Other times, waiting, preparing, or exploring alternative strategies may be the smarter play. What matters most is having the right information, realistic expectations, and a plan that fits your circumstances.

At The Dan Gemus Real Estate Team Ltd., Brokerage, we believe in professionalism and honesty. Our goal is to help our clients realize the best terms on the purchase or sale. If you have questions about the real estate market in Windsor and Essex County, reach out to our team 7 days/week: 519-566-5565 and find us online: www.DanGemus.com. We are happy to provide you with a free home market evaluation, or a buyer consultation so you can make the decisions with the right information to work towards your goals and plans for the future.

*This blog is not intended to replace legal, financial or tax advice, nor is it intended to solicit those under contract with another Brokerage.