Will 2025 end an era of unpredictability in the real estate market?

The Canadian housing market has faced significant challenges over the past few years, from the global pandemic to rising interest rates and economic shifts. Although we don’t have a crystal ball, according to a report released by Royal LePage Canada, 2025 is expected to bring more stability, aligning with long-term trends and offering new opportunities for homebuyers.

A Return to Stability

After years of market volatility, key indicators suggest a more balanced real estate market in 2025. Many prospective buyers, waiting for favourable conditions, are expected to re-enter the market, supported by improved mortgage lending rules and declining interest rates.

New Lending Rules to Benefit Buyers

Changes in mortgage lending regulations, effective December, aim to make homeownership more accessible:

- 30-Year Amortizations: First-time buyers and those purchasing newly built homes can now qualify for 30-year amortizations, increasing affordability.

- Higher Mortgage Insurance Cap: The cap for insured mortgages will rise from $1 million to $1.5 million, helping buyers access properties in higher price ranges, especially in markets where home prices exceed $1 million.

These adjustments are expected to benefit first-time buyers the most, allowing them to borrow more with smaller down payments. Improved lending conditions, paired with falling interest rates, will open doors to more housing opportunities.

Boosting Housing Supply

With buyers returning to the market, builders are likely to ramp up new construction. Addressing Canada’s housing shortage remains a priority, especially as population growth through immigration continues to drive demand. Increased housing supply is crucial to improving affordability, whether for home purchases or rentals.

Potential Impacts from Political Changes

Elections in Canada and the United States in 2025 could bring shifts in housing policies, trade relations, and immigration rules. These factors may influence the real estate market, consumer confidence, and economic conditions, creating some uncertainty in the latter half of the year.

Regional Highlights

While the national market is expected to stabilize, regional variations will persist:

- Strong Price Growth: Cities like Quebec City, Edmonton, and Regina are forecasted to see significant price increases.

- Moderate Gains: Areas such as Toronto, Vancouver, and Calgary are expected to experience steady but slower growth.

- Condo Market Adjustments: The Greater Toronto Area may see a slight dip in condo prices as new units come onto the market.

Looking Ahead

With the potential for a more balanced housing market on the horizon, 2025 offers promise for buyers and sellers alike. Whether you’re a first-time buyer, looking to upgrade, or downsize, now is the time to prepare for the opportunities ahead.

If you’re planning to buy or sell in Windsor, ON, The Dan Gemus Real Estate Team is here to help you navigate the market. Contact us today to start your journey toward homeownership or to explore your options in this evolving market.

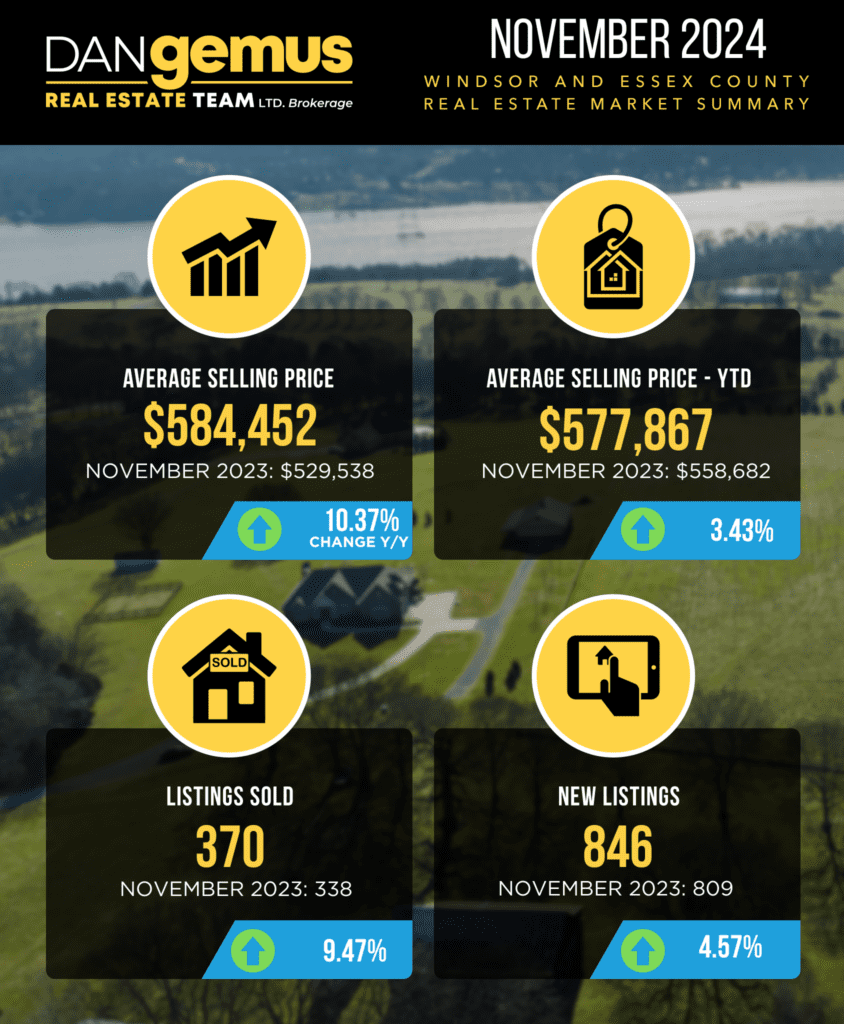

The pictograph shows the residential market stats update for the month of November, 2024. For regular market updates for the Windsor and Essex County region, sign up for our monthly newsletter so you can keep tabs on the trends in the Windsor and Essex County real estate market.